5 Reasons You Should Go 'All In' With Your Bank or Credit Union Investment Services Program.

Mark Hoaglin, National Sales Manager, CFS/SPF

During my career I have experienced a variety of levels of commitment from bank and credit union executives when it comes to the support they provide to their investment/wealth management programs. It has always puzzled me that more banks and credit unions don’t view this important service as a “core” offering. I have worked on both sides of the balance sheet during my career and have witnessed the many benefits that are derived from having a fully integrated program. Here, I share my top five reasons why you should go 'all in' and give your full support to your retail wealth management/investment services program.

1. Retiring with enough money is the number one financial pain point of your members and customers. That’s right; the people walking into your lobbies and calling your call centers are more concerned about their retirement income than they are about the latest credit card deal or loan rate. The problem is they probably don’t know that you offer a service that can help them. Let them know! Spread the word in conjunction with your other core products and services. Better yet, throw some weight behind the development of the program.

2. Fee income is important but synergy rules the roost. Many times over the years I have asked the question, why don’t you provide sufficient support to the investment program? One CEO responded, “Mark, the revenue from the investment program is a

'drop in the bucket' compared to our loan programs.” I get it; however, he was overlooking a critical advantage to supporting his investment/wealth management program. Those banks and credit unions that go 'all in' reap the benefits of more loyal and profitable members and customers.

According to the 2015 Kehrer Bielan Research & Consulting study, The Value of an Investment Client to a Bank or Credit Union, bank customers and credit union members with investment accounts are 58% more likely to have a credit card, 122% more likely to have a first mortgage and 613% more likely to have a second mortgage than those without investment accounts. In addition, investment households are twice as likely to have a vehicle loan than non-investment households. Do you want to increase your loan production? Provide more support to your investment/wealth management program.

3. Disintermediation is a non-issue. If I had a dollar for every time I heard the excuse that investment programs deter a bank or credit union from its efforts to gather deposits I could buy a couple of shares of Apple. I submit that just the opposite is true. According to that same Kehrer Bielan study, investment households studied had an average of $28,000 in savings – 140% greater than the average savings account balance of other households. So if you want to retain/increase your deposits, support the financial advisors sitting in your branches.

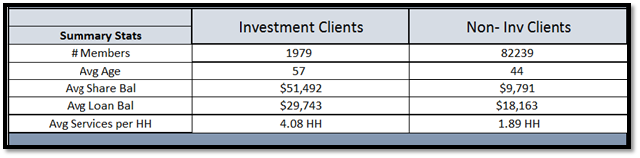

“Oh that’s just a study, you say? Here is a current example from one of our credit union clients that conducted their own study:

4. Investment/Wealth Management households are your most loyal households. Years ago, people would say that if you want to get a loyal household just get them to sign up for a direct deposit. It’s such a pain to change they will never leave. Well you might keep their Social Security coming into their checking account but not much else. Their 'real' money is down the street where they have their investment account. Investment households are 27% more likely to stay with their bank or credit union where they have their investment relationship than other households, again according to that same Kehrer Bielan study.

5. Your investment/wealth management program is the gift that keeps on giving. The days of the 'one and done' transactional advisor are behind us. More and more programs and advisors are embracing the benefits of fee-based accounts and managed money. Recurring revenue from these financial solutions grow exponentially over the years. No longer does a program or advisor start from zero each January or each month. A bank or credit union that makes a long term commitment to their investment/wealth management program will reap the benefits of exponential growth in the future. That revenue will sustain a program’s fee income contribution and cover its costs.

So the question is, are you just 'dabbling' in your investment/wealth management program or are you ready to go 'all in'? If your credit union members and bank customers had a vote I guarantee they would want you to go 'all in'. Great service is all about providing for your members' and customers' greatest financial needs. Having a best-in-class investment/wealth management program is what your members and customers need. If you don’t provide it, the competition will -- and we all know that the competition for our members’ and customers’ wallets is growing each day.

author: Mark Hoaglin

National Sales Manager

mhoaglin@cusonet.com